Championing you and your bold idea

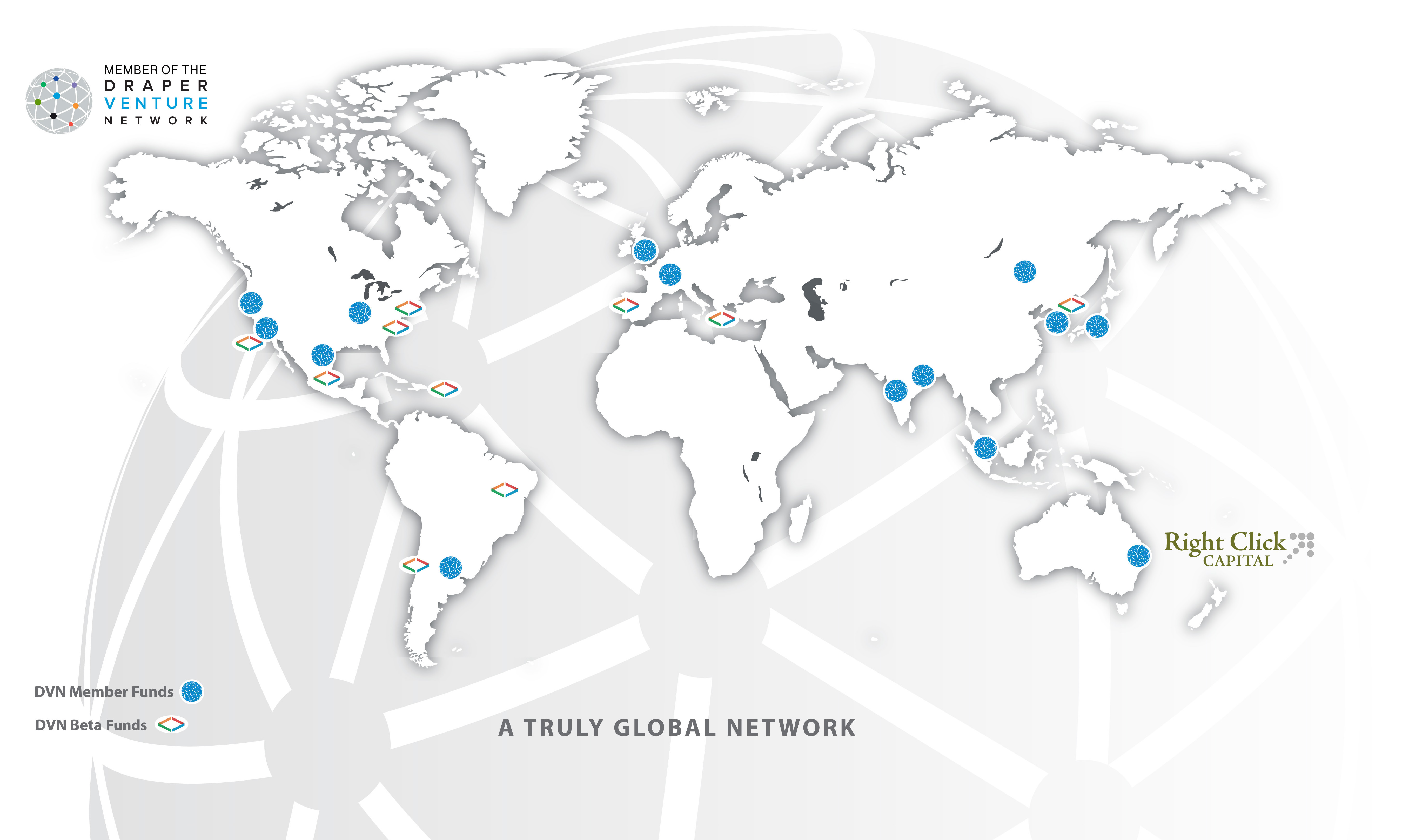

As the Australasian member of the Draper Venture Network, we’re extremely connected in the tech startup ecosystem. We leverage our global team of resources, allies and co-conspirators to unlock mutually-beneficial opportunities and value, placing you on the path to enduring success.

Frequently asked questions

To keep pushing transparency and openness in the community, here is a set of questions we often receive, and here are our straight answers.

When should you reach out to Right Click Capital

I’m deciding whether or not to raise capital. Do you have any advice?

Bringing in any external investor is a serious decision. We advise seeking capital if it enables your tech. startup to grow quickly – provided that growing quickly is a disproportionate advantage. (Note: this isn’t the case for all markets.)

If you do decide to seek an investment, we recommend you understand the types of investors out there (e.g., angels, VCs, corporate VCs, and “strategic” investors), the ways VCs add value to companies, and the kind of investor style that best suits your situation.

In our view, backing a startup is a long-term relationship. We actively work together with founders and early employees, so many of our decisions centre around fit.

I'm not sure I'm quite ready for a capital injection. Should I still reach out?

Yes. We’ve been through it and know how hard it can be. We love sharing our experience with those just starting up/at the beginning of the journey.

At what business stage do you usually invest?

Our first investments are focused on pre-seed and seed, but we occasionally fund a series A or series B round. We also make follow-on investments in startups we’ve previously backed.

For pre-seed or seed rounds, we prefer startups who are more than an “idea on a page” – that is, they have a team in place and a minimum viable product. For series A, we expect to see traction and early unit economics.

For any startup we back, our mission is to inject more than pure capital. We’re most excited about funding the kind of startups that will rapidly grow and flourish through our local and global networks.

Do you invest in startups located outside Australia?

Yes. We invest in startups based in Australia, New Zealand, and South East Asia. For startups based in South East Asia, we tend to follow instead of lead rounds. For startups based in Australia or New Zealand, we are very open to both leading rounds and following.

I’m raising series B or C. Should I reach out?

For first time investments, we occasionally participate in series B or (smaller) series C rounds. At that stage, the startup usually needs to have a phenomenal fit with our networks and expertise. If this sounds like your startup, definitely reach out to us.

How we make decisions

Does Right Click Capital invest only in certain industries?

We invest in and back technology-based startups in any sector, except for certain biotechnology areas (e.g., we do not have substantive expertise in drug discovery). Most of our investments have historically been in software-enabled startups (both B2B and B2C), deep tech., and the Internet of Things (IoT).

Instead of specialising in any one sector, we are open to ambitious founders who are experts in their chosen fields – founders who can show us why their industries are ripe for disruption, how their markets will play out in the coming years, and why their products or services can win.

What do you look for most in a founding team?

We tend to back founders who are experts in their own fields and who have a strong connection to problem they and their startup is tackling. We also look for founding teams with technical as well as commercial expertise.

What’s your general process to make an investment decision?

The process can vary greatly between startups we are considering. Sometimes we spend years getting to know startups prior to backing them and sometimes we go from an initial meeting to a term sheet in only a few days. That said, here are some general steps we go through with most startups. The number of investments that make it through each stage vary greatly by company sector and funding round type.

Initial review: The investment team reviews every deck or executive summary we receive. Initially we determine if the startup fits our broad mandate and try to work out if the startup is a direct competitor with any of our existing investments.

First chat: We have an initial meeting (or a phone call) with the founding team, which is 30-60 minutes.

Deep dives: There may be one or two follow-up meetings so our investment team can get to know the founders and understand the team and business. If a startup is further along, we may ask for a few specific pieces of data.

Final decision: The full investment team does a final dive into two areas. First, we review the founding team (and possibly their early employees), the market segment, and the business model. Second, we evaluate our own experiences, global networks, areas of expertise, and our ability to add substantial value to the company.

We pass on the investment if either area is not a great fit. That’s because we want to be fully committed to the startups we back. If we go in, we go all in.

Will you sign my NDA or confidentiality agreement?

No. Like most larger VC firms in Australia and in the USA, we do not sign NDAs (except in exceptional circumstances such as for an unusually late stage company). That said, the venture community is built on mutual trust and reputation. You can read a lot about this online, such as Mark Suster’s page here.

Our investment process and terms

What size rounds does Right Click Capital usually invest in?

There’s no minimum cheque size for us, but we rarely go below $100k. We can lead rounds up to $10m. For rounds larger than $10m we usually only follow.

For startups in our portfolio, we are very comfortable bringing investors together for subsequent rounds and making follow-on investments in much larger rounds. (Our team has co-invested with over 100 other investors around the world.)

How long does it take to get a signed term sheet?

The process can vary greatly between startups we are considering. Sometimes we spend years getting to know startups prior to backing them and sometimes we go from an initial meeting to a term sheet in only a few days. In general, if you need a decision from us very quickly (i.e., in a few days) then it just raises the conviction we need before jumping all in.

Will you only invest if you lead the round?

Unlike some investors, we are comfortable with either leading or following investment rounds. For us, it all depends on what is best for the startup.

What is it like to work with us?

How do you help startups grow?

Our aim/mission is to amplify the startups we back, so we give the kind of support that translates into the biggest and most meaningful impact. Sometimes this is a helping hand with strategy development, sales, marketing, media or operations. Other times, we can be the trusted thought partner you need when the going gets tough.

Crucially, the founders we invest in are linked/have access to our global network of investors, funds and founders, including via the Draper Venture Network. Through our extensive connections, we can source industry data and strategic opportunities for founders, find subject-matter experts and mentors they need.

Do you make follow-on investments in your portfolio companies?

Yes. We are very open to follow-on investments in our portfolio companies in series A, B, and C rounds. As some startups continue to grow, it can be helpful having different investors lead subsequent rounds (they bring different perspectives and it can help with governance). In these situations, we’re very comfortable bringing groups of investors together even if we’re not leading the round.